Use Home Bookkeeping - a program to manage and control finances for both personal and family budgets. Available for computer and on Android and iPhone / iPad mobile devices. Use sync and access your recordings on your computer, smartphone and tablet.

In addition to accounting for personal finances and control of the family budget, Home Accounting will help to keep financial records for individual entrepreneurs and small companies.

The program will allow you to create an effective financial plan, calculate income and expenses.

Complete control over home finances!

Five reasons to start using Home Bookkeeping today:

- Simplicity - No special accounting knowledge required

- Benefit - Keeping records of household finances will help you achieve your goals

- Benefit - By analyzing your budget, you can avoid unnecessary expenses

- Practicality - A complete set of functions necessary to control the family budget

- Safety - Password protection of records and database backup function

Features of Home Bookkeeping

A program for keeping track of expenses and incomes of family budgets and personal finances

Keep track of the personal finances and finances of all your family members. To ensure confidentiality, each user's records can be password protected.

Enter all your expenses and income into Home Bookkeeping to keep your finances in full control. Make your financial plans and budget.

Full control of loans and money given in debt, including control of their return with the functions of calculating the payment schedule and reminders.

All currencies of the world are in the list of currencies of Home Bookkeeping. Select the currencies you are using.

The synchronization function allows you to exchange data with Home Bookkeeping installed on another computer or on an Android mobile device, iPhone, iPad.

Home bookkeeping helps you analyze your finances with a variety of reports and visual charts.

Import your bank statements into Home Bookkeeping. If you need to transfer data from Home Accounting somewhere, then the export function will help.

With a reliable backup system, be sure that your data is always completely safe and you will never lose it.

Home Bookkeeping Reviews

Home bookkeeping is constantly used hundreds of thousands Human. Check out some of our user reviews.

faith

Agapova

Great software! I have long wanted to try for planning and maintaining a family budget - I'm happy. There is a possibility of copying, synchronization both by cable and via the cloud. Home bookkeeping has long been a reliable assistant in personal finance management.

Ekaterina

Yatsenko

The best application of its kind for home bookkeeping. Now I can quickly and competently draw up a personal financial plan, visually see the movement of income and expenses. A big advantage is the ability to save your data, and I can easily keep track of household finances from a tablet. I advise everyone who wants to manage their personal finances safely and easily.

Alexander

Vakhramov

Great program! This is the best personal financial assistant for any family, full control of income and expenses, all personal data is saved, and I can use the program even from a tablet. Very useful for home bookkeeping when there is not enough free time. I advise everyone!

Olga

Honeypunk

Super program is the best tool with which it is easy to keep track of household finances. I have been using it for 8 years, family accounting is under control. It helped a lot in the correct accounting of own income and expenses, planning large purchases. I'm happy!

Alexander

Pavlov

A very convenient and useful application! The home bookkeeping software helped not only to manage personal finances, but also in general financial planning for the family. Of the advantages, I want to note the complete control and reliability of personal finances. I recommend it to everyone for home bookkeeping.

Ludmila

Potapova

I love this program very much, I've been using it "to the penny" for 3.5 years. Home bookkeeping helps to plan large purchases correctly, control income and expenses. I consider the possibility of separate management of the family budget and control of personal finances as a great advantage.

Alex

Apatenko

Home Bookkeeping is the best personal financial assistant! I started using Home Bookkeeping to plan the purchase of a car, as a result, the whole family uses this program to manage household finances. The security of personal finances and the ability to maintain and control personal income and expenses for each family member are considered a big plus. Thanks for the great program!

Nina

Bogdanova

Great software! I have wanted to try it for a long time - I'm happy, synchronization both by lace and by dropbox. There is a backup option, full control of income and expenses. The Home Bookkeeping program has greatly helped in financial planning, not only for the family budget, but also for the personal one. Recommend!

Albert

Khuzhakhmetov

The home bookkeeping software helped me not only to control the income and expenses of the family, but also to organize the planning at work correctly. Simple management, the ability to easily manage personal finances - these advantages have already been appreciated by my whole family! I recommend home bookkeeping to everyone, great program!

Where did all the salary go? Who is to blame that money is slipping through your fingers? How to clean up your personal finances? If you, like me, are worried about these issues, it's time to become your own accountant.

No, we are not going to study balances and holdings, we don’t need to learn reversal transactions and currency clearing. In today's review - 3 free programs for home bookkeeping. All of them are intended for those who, like me, have absolutely no knowledge of economics.

AceMoney Lite

- "little brother" of a comprehensive personal finance management tool - the paid application AceMoney. Unlike the full version, Lite only allows you to manage two accounts, but for many of us this is enough.

An account in IceMoney is not only a bank card and savings book, but also a collection of cash belonging to a family or one person.

Application features

- Management of personal cash flows in currencies of 150 countries of the world.

- Track exchange rates in real time.

- Distribution of the budget for various needs: the application contains more than a hundred various items of expenditure.

- Tracking regular income and spending (salary, apartment payments, loan payments, top-up phone balance, etc.).

- Calculation of expenses for specific purposes for a certain period of time. A couple of clicks - and you will find out how much you spend on food every month, how much on gasoline, etc.

- Generation of reports by accounts, categories and correspondents (recipients of payments from you and those from whom you receive them).

- Export of reports to Excel and html formats.

- Obtaining information on the state of a bank account directly from the bank.

- Tracking the value of stocks - for those who.

- Calculation of savings, debts, mortgages.

- Hotkey control.

- Flexible settings, enable, disable individual elements and much more.

The program has a Russian-language reference manual plus on the developer's website.

How to use AceMoney Lite

Working with AceMoney Lite begins with creating an account. To do this, press the button of the same name on the top panel and click “ Add account". We indicate its name, group (for example, bank deposit, cash or credit), number (if any), bank name, interest rate, currency and other data that you need.

Next, we enter information about the replenishment and: click on its name and select “ New transaction»(A record of an incoming or outgoing transaction). In the window " Transaction»Mark its type (income, expense, transfer), correspondent, category (what you spent on - choose from the list or write manually), date, number, amount and comment.

While in the same section, you can download transactions directly from the bank's server, if the latter provides such services. It is possible to balance the balance for several transactions.

Recurring transactions (salary and recurring payments) are added to the program through the section " Schedule". Click on the button " Add payment»And indicate the parameters - frequency, duration, type (income, expense, transfer), source, correspondent, category, amount, etc. Regular transactions will be included in the list of operations automatically.

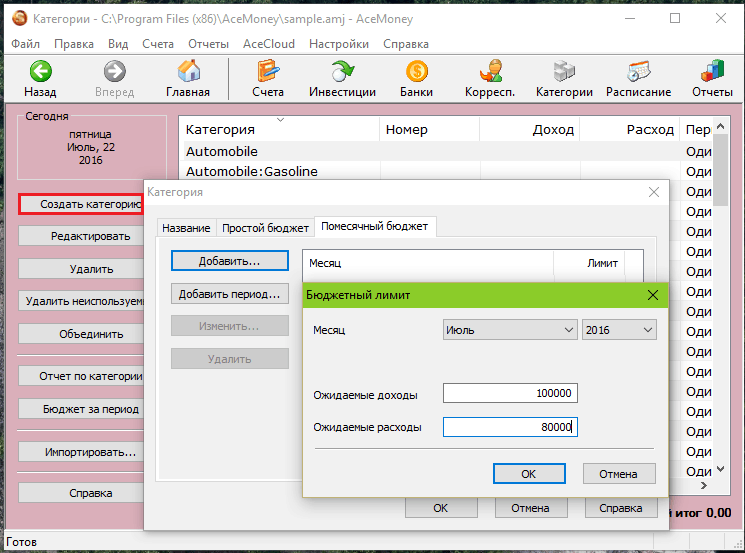

The distribution of finances for various needs (budget) is carried out in the section " Categories". Here we can select several predefined items of income and expenses (refueling the car, spending on food, etc.) or add our own. When creating and editing a category, you can set a different budget period, indicate the expected income and expenses, as well as the limit.

In general, AceMoney Lite copes with its tasks very well. Users note that thanks to the program, they managed to reduce their monthly expenses by 10-30% and finally understand where the money is going. It has only one drawback, more precisely, the current version - 4.36: writing categories in English.

AbilityCash

At first glance, the program seems incomprehensible and unfriendly - the windows are inconspicuous and half-empty, no explanations, no help (not yet written). But if you spend 15-20 minutes studying, you will discover a lot of its advantages. Many of those who have mastered AbilityCash consider it more convenient than AceMoney, and generally one of the best free home accounting software.

Main features of AbilityCash

- Creation of invoices without quantity restrictions and in different currencies.

- Tree structure of income-expense items (you can add as many subcategories as you need).

- Import and export of data in xml and Excel formats.

- Loading current exchange rates (optional).

- Compilation and printing of reports on exchange rates, fund balances and turnover dynamics.

- View transactions by items of income and expense for a selected period of time.

- Support for Ukrainian and Lithuanian languages (selected during installation).

The following options are disabled by default:

- Tree structure and additional charts of accounts.

- The budget period in operations.

- Fields "Price", "Quantity" and "Time" in the list of operations.

- Several note fields that you can give your name to.

To activate any of this, go to the menu " File"And click" Data file settings».

How to use

Using AbilityCash, like AceMoney, begins with creating accounts and specifying the current balances of funds on them. To do this, open the first tab and press the " Insert". In the window, write the name of the account, select the currency and indicate the balance.

By default, there is only one currency in AbilityCash - the Russian ruble. To install additional ones, press Ctrl + R and download the current data from the website of the Central Bank of Russia. In the last window, select the currencies you want to display in the application.

To the section " Operations»(By analogy with AceMoney transactions) information about specific purchases, payments, receipts and money transfers between accounts is entered.

To get a summary of the state of finances or exchange rates, open the tab " Reports».

AbilityCash is undoubtedly a worthy tool for keeping track of personal funds. And it would be even better with contextual help, which the developers don't seem to remember about, and a more user-friendly interface. However, there is a short one on the official website. There is also where you can ask a question, if something is not clear, or report a problem.

Economy

The program "" is designed, perhaps, for those who are not at all friendly with accounting science and for whom the concepts of "transaction" and "investment" evoke deep melancholy. There is no scientific terminology in it and everything is so simple and understandable that both a child of 10-12 years old and a person of venerable age can use it. The only limitation of the free version is that the total monthly income is no more than 14,000 rubles.

Application features

- Creation of any number of accounts and accounts, including foreign currency.

- Keeping records in the currency of several countries.

- Separate items of expenses, income and debts for each user.

- Reminder function for recurring payments and delays in loan (debt) payments.

- Creation of reports on several categories: fund balances, income for a period of time, debts and loans, expenses of each user for a given time period, income minus expenses.

- Filtering data for viewing.

- Automatic backup.

- Built-in Russian-language help.

- Go from the main menu to the developer's site.

For faster mastering of the program, you can download a demo file immediately after installation. In it - an example of managing the budget of a family of two people.

How to use

First, let's create a user and link all of his accounts to the account:

For accounting of expenses and income. Now it's time to choose the best Android family budgeting app.

Modern technologies have allowed developers to create a full-fledged software platform - the Android operating system. Thanks to this system, the market for mobile applications was born. Many developers began to release mobile versions of their programs that are adapted for smartphones and tablets. The largest players in the mobile OS market are platforms such as Android and iOS.

In the official app store play.google.com, you can find many decent programs that will make it easier for you to do home bookkeeping. Despite the wide variety of software, there are not many truly high-quality applications.

Read also:My Wallet - My Money Tracker Lite

![]() My Money Tracker Lite is a personal finance tracking application. There is also a paid analogue of the program - the Pro version. MyMoneyTracker does a pretty good job of keeping track of income and expenses. After starting the application, the user enters the transactions section. By clicking on the red lightning button at the bottom of the screen, you can quickly add an expense or income transaction. Before making a transaction, you need to select its name, for example, clothes, food, gasoline, and also indicate the amount. You can add an expense through the top menu (three dots - "add a transaction"). The program contains a two-level reference book of operations (for example, categories and subcategories: children / toys, children / kindergarten). To arrange the reference books for yourself, you need to enter the settings section (the third icon from the top), go to the "groups" and click the "add group" button on top. For the new element, you need to set the name of the group, the type of operation (expense or income), the icon, and also indicate whether this group is the default element (if so, it will be displayed when added via the lightning button on the main screen).

My Money Tracker Lite is a personal finance tracking application. There is also a paid analogue of the program - the Pro version. MyMoneyTracker does a pretty good job of keeping track of income and expenses. After starting the application, the user enters the transactions section. By clicking on the red lightning button at the bottom of the screen, you can quickly add an expense or income transaction. Before making a transaction, you need to select its name, for example, clothes, food, gasoline, and also indicate the amount. You can add an expense through the top menu (three dots - "add a transaction"). The program contains a two-level reference book of operations (for example, categories and subcategories: children / toys, children / kindergarten). To arrange the reference books for yourself, you need to enter the settings section (the third icon from the top), go to the "groups" and click the "add group" button on top. For the new element, you need to set the name of the group, the type of operation (expense or income), the icon, and also indicate whether this group is the default element (if so, it will be displayed when added via the lightning button on the main screen).

To build reports, you need to go to the appropriate section (the second icon from the top) and select the type of report. In the current version there are seven types of reports, of which the most popular are the following: expenses / incomes by months, transactions by group / subgroup. The report is available both in the form of a chart and in a table view.

![]()

Conclusions. In general, the application left a pleasant experience. During testing, no failures or errors were found. The program interface is simple and functional. You can add a transaction in two taps (plus entering numbers). As for the reports, they are also quite informative. My Money Tracker Lite has established itself as a simple and reliable tool for monitoring family budget.

Read also:1Money - convenient expense and income tracking

The functionality of the 1Money application is slightly wider than that of the previous program, but there is one significant drawback - the free version has serious restrictions (for example, there is a limit on the number of accounts and categories). If you can get by with two accounts (cash and a card) for conducting personal accounting, then the 1Money application will do just fine.

The functionality of the 1Money application is slightly wider than that of the previous program, but there is one significant drawback - the free version has serious restrictions (for example, there is a limit on the number of accounts and categories). If you can get by with two accounts (cash and a card) for conducting personal accounting, then the 1Money application will do just fine.

I would like to note an interesting approach to the design of the main screen of the application (category section). Here is a list of expense categories with the cost of each transaction in the current month. To view the structure of expenses for the previous month, just slide the screen to the right (or select a time interval from the top). If you are interested in income, then you need to click in the center of the screen and you will receive the income structure for the selected period. The circle in the center of the screen under the "Categories" section is also a chart that shows the share of expenses for all involved categories. There is no category hierarchy in the application, that is, the transaction reference has one level. Whether this is a disadvantage is difficult to say, because a two-level guide would compromise clarity.

It is very easy to add a transaction - just click on the corresponding inscription in the "categories" section. After entering the consumption, it is automatically added to the previous value for the selected category. In the "overview" section, you can familiarize yourself in more detail with the expenses and incomes of your personal accounting department - a detailed report is presented here in a tabular form. At the top of the section there is a diagram that shows the dynamics of expenses and incomes by day.

Conclusions. I was pleased with the approach to the design of the interface - at first everything seems unusual, and then the realization comes that it cannot be more convenient. The limitations in the free version are upsetting, for example, you can add only one "your" category of expenses, you cannot use more than two accounts. It can be seen that the developer tried very hard and thought out well the functionality and interface of 1Money, but he was clearly greedy with restrictions. If you need a colorful and visual tool for home accounting, then you can recommend the free version of the program only if you later switch to the paid one.

Personal finance manager

The application has a wide range of functions. It has everything you need to control your family budget: keeping track of income and expenses, planning, debts, foreign currency accounts and much more. A personal financial manager is noticeably superior to competitors in terms of functionality, but loses to them in terms of interface design. The appearance of the program is rooted in the past - to the first versions of Android. If you are not confused by such an interface, then this application will become a reliable assistant in the field of personal finance.

The application has a wide range of functions. It has everything you need to control your family budget: keeping track of income and expenses, planning, debts, foreign currency accounts and much more. A personal financial manager is noticeably superior to competitors in terms of functionality, but loses to them in terms of interface design. The appearance of the program is rooted in the past - to the first versions of Android. If you are not confused by such an interface, then this application will become a reliable assistant in the field of personal finance.

To add a transaction, for example, an expense, you need to click the plus opposite the “expenses” section. Then we fill out a simple form - we indicate the name of the operation, the wallet to be debited, the amount, date and category. It is interesting that you can enter the name of the transaction and its description. With such information content, you will definitely not get confused in your notes. Pleased with a fairly detailed and voluminous directory of cost categories. Unlike the previous appendix, here the reference book is two-level (for example, you can specify "car - fuel"). This directory is easy to edit, it supports nested subcategories (for example, you can create "children - school", "children - gifts"). A profitable transaction is executed in the same way. I was also pleased with the income directory - it is already filled out and supports nested subcategories.

The list of debts can be drawn up in the "Debt Management" section. Everything is simple here - there are two types of debt (“borrow” and “lend”). It's a shame that there is no automatic notification of overdue debts. Such a notification can be issued independently in the "planning" section. Another cool feature is setting limits by category and by wallet. Such a limitation will be useful for those who are used to mindlessly spending money.

With reports in the Personal Finance Manager, everything is also in order - you can get a report in the form of a pie chart and in a tabular form. You can separately see how much money was spent in a given category. Another useful report is cost / income comparison. This function will be useful, for example, to compare expenses for the past and current months.

Conclusions. The application has all the functionality for effective control of personal finances. The feature set is pretty good, especially for a free app. There are flexible settings for directories and user accounts. The reports are high-quality and informative. We can confidently recommend the program to those for whom the "colorfulness" of the interface is not in the first place.

KeepFinance: expense and income tracking

KeepFinance can be classified as a professional tool for controlling personal finances. The functionality of the program allows you to import transactions from SMS messages of banks. To do this, you just need to configure message templates once. The main screen is very informative - here you can see account balances, a summary of expenses, and even reminders of important payments. The top bar has icons representing "plus" and "minus". Through them, you can register income and expenses.

KeepFinance can be classified as a professional tool for controlling personal finances. The functionality of the program allows you to import transactions from SMS messages of banks. To do this, you just need to configure message templates once. The main screen is very informative - here you can see account balances, a summary of expenses, and even reminders of important payments. The top bar has icons representing "plus" and "minus". Through them, you can register income and expenses.

To quickly add a flow rate operation, use the right screen (scroll to the left) - here you can add a flow rate in two touches. To do this, enter the amount, indicate the account to be debited and the category of expense. Another "feature" of the application is that you can see the current balance on the lock screen of your smartphone. One gets the feeling that you are not carrying a phone with you, but a wallet. There is a function of planning expenses by category - you can set the appropriate limits and monitor the approach to them.

It should be mentioned that the free version of KeepFinance has some limitations: only one wallet is available, no more than five accounts can be used, as well as one source of income. There are also limitations regarding reports - only simple reports on income and expenses are available in the free application. Despite this, the information content of the reports is quite enough for the effective management of personal finances. To build reports, you need to go to the "summary" section (through the main menu). Everything is simple here - we select the reporting period and get a summary of expenses and income (at the bottom there is a panel for selecting the type of report - expenses, income and summary).

The directory of income and expenses is single-level (that is, there are no nested categories). This is unlikely to be a drawback of the application, but some advanced users may experience inconvenience.

Conclusions. The KeepFinance application left a pleasant impression - a well-thought-out interface and ease of data entry make the program quite attractive. The basic (free) feature set will suit any family budget. For the lazy, there is a useful function - recognition of transactions in SMS messages from banks. Once I set up templates, and the application itself enters the data (if you pay with a bank card). The program will be useful not only for beginners, but also for more advanced users who need advanced functionality for home bookkeeping.

Home bookkeeping lite

Home bookkeeping is one of the oldest and most popular applications on the market for personal finance control software. Despite this, the program clearly loses to its free competitors in terms of usability. The free version has all the necessary tools for home bookkeeping, but the program interface itself, in our opinion, cannot be called friendly. This is not the main criterion for evaluating the application. The set of tools is quite extensive: accounting of expenses and income, multicurrency, expense planning, debts and loans, detailed reports and much more.

Home bookkeeping is one of the oldest and most popular applications on the market for personal finance control software. Despite this, the program clearly loses to its free competitors in terms of usability. The free version has all the necessary tools for home bookkeeping, but the program interface itself, in our opinion, cannot be called friendly. This is not the main criterion for evaluating the application. The set of tools is quite extensive: accounting of expenses and income, multicurrency, expense planning, debts and loans, detailed reports and much more.

The free version has a number of limitations, for example, only one user and three accounts are supported. When you try to add a second family member or a fourth account, you are prompted to buy the full version of the program.

Reports are not the strongest point of this application. Here the claims are not so much to the reports themselves (they are quite informative), but to the process of setting them up. We tested and there were also similar difficulties. For some reason, all generated reports are saved in the list, and to get a report, for example, on monthly expenses, a chain of actions is required: go to the "reports" section, click the "reports" inscription at the top, select the report type and specify the period.

Why not make it so that in the "reports" section, a monthly report on expenses and income is immediately built, and only then it would be suggested to set additional parameters and filters. Agree that four steps to get a simple report is too much for a mobile application.

Conclusions. The app does a good job with home bookkeeping - it has a good set of tools. If someone lacks the basic functions (the free version of the program), then you can always upgrade to the premium version. Of the minuses, a slightly tricky interface and its low information content can be noted, which is quite critical for a small screen.

If you are one of those people who care about every penny spent, then most likely you will be interested in this a selection of mobile applications for home bookkeeping and personal finance on Android... With the help of these applications, you can easily keep track of your income and expenses, make a plan, see the result in the idea of charts and sort the spent funds by category.

Today's review of the most popular applications for "home bookkeeping" includes: AndroMoney, Expense Manager, "Family Budget", EasyMoney, CoinKeeper and "Home bookkeeping".

AndroMoney

- Category: Finance

- Developer: AndroMoney

- Version: 2.7.12

- Price: Free - Google Play

- Pro version for $ 5 - Google Play

AndroMoney- multifunctional application for "home bookkeeping" for Android. According to the developers, creating this application, they wanted to make it with an intuitive interface, a huge number of various settings and additional functions that would help in the daily management of users' expenses and income. It is safe to say that they succeeded.

Thanks to its wide functionality, each user will be able to find suitable reporting tools for themselves. A distinctive feature of this application is the fact that you can set a budget for: one day, month, year, or a separate budget for the selected category.

In addition to all of the above, the AndroMoney application can create backups of your accounting records while saving them both to a memory card and to the cloud storage Dropbox or Google Drive. Also, if desired, each user can save his report in CVS format and continue working with it on a personal computer.

pros:

- Convenient intuitive interface;

- Wide functionality and many additional settings;

- Data backup;

- Converting to Cvs format for further work on a PC;

- Password protection and more.

Minuses:

- During the testing of the application, no minuses were found.

Expense Manager

- Category: Finance

- Developer: Bishinews

- Version: 2.0.5

- Price: Free - Google Play

- Pro version for $ 5 - Google Play

Expense Manager- there are several applications with a similar name on Google Play at the moment, but it is the application developed by Bishinews that is the most popular and popular in the opinion of users. This can be judged by the download counter in Google play, which recently reached the mark in 5 000 000 downloads.

The functionality of the application is huge, but the most important thing is planning your finances. Yes, the developers did not endow the program with a Russian interface, but in principle it is not needed, because everything is clear and convenient here. Initially, entering the program in front of us will be a template with several items of expenses, which, if desired, can be changed by going to the settings. You can also very easily view the necessary payments or look at a detailed and visual schedule of expenses.

As well AndroMoney, this application can easily back up your reports to the Dropbox cloud storage or your device's memory card. A distinctive feature of this application is the presence of a built-in currency converter, which, by the way, works only with an Internet connection.

In the Google Play store, this program is available in two versions: a free version and a full version, which can be purchased for $ 5, but with more functionality.

pros:

- Convenient minimalist interface;

- Many useful features;

- View reports in the idea of graphs;

- Data backup;

- Currency converter (only if you have an Internet connection).

Minuses:

- Limited functionality of the free version;

- There is no Russian language

"Family budget"

Developer: maloii

Version: 2.1.11

"Family budget"- the official mobile client for Android, which exactly repeats the functionality of one of the popular web services for accounting. The developers claim that their service is the most convenient for planning expenses, and it will also easily allow you to keep track of the family's budget and spend money more efficiently.

The application turned out to be no less simple and convenient, thanks to which it is quite simple and convenient to use it, and the presence of huge functionality allows you to easily monitor financial affairs in your family directly from your phone or tablet.

Each created report can be viewed in the form of graphs that more clearly display all the necessary information on spending money. The interface of the application turned out to be quite convenient, there are no unnecessary elements and unnecessary functions. A convenient function of this service is automatic synchronization with an Android device, which allows you to quickly and comfortably transfer data entered on the site using a PC to a mobile device and vice versa.

pros:

- Convenient interface;

- Maximum settings;

- Synchronization with the service;

- Visual display of reports in the idea of graphs.

- There is a "desktop" version of the service

- Category: Finance

- Developer: Handy Apps Inc

- Version: Depends on the device

- Price: Free - Google Play

- Pro version for $ 10 - Google Play

EasyMoney- the most expensive and most functional application in this category of applications. But judging by the number of downloads in Google play the price of the application does not stop users at all, especially since there is a free version of the program and you can test the initial functionality on it, and only then decide whether it is worth spending money on this program or not.

Of all the functionality that is in the program, I would like to note such opportunities as: displaying interactive reports and charts, maintaining several accounts in foreign currency, maintaining a home budget and tracking investments and the balance of plastic cards.

With the data backup function, you don't have to worry about the safety of saving your reports. You can easily transfer all the work done to a memory card or export reports in the format QIF (CSV).

pros:

- Huge functionality;

- Visual reports in the form of interactive graphs;

- Transfer of ready-made answers to the memory card;

- The presence of a convenient widget.

Minuses:

- Not entirely clear interface;

- Lack of Russian;

- High cost for the full version of the program.

CoinKeeper

- Category: Finance

- Developer: IQT Ltd

- Version: 1.5.3

- Price: Free for the first 15 days - Google Play

"Home bookkeeping"

- Category: Finance

- Developer: Keepsoft

- Version: 5.2.128

- Price: 4 $ - Google Play

Outcome:

Surely each of us cannot imagine life in the modern world without mobile devices. After all, with their help, you can solve many important problems, for example, make a shopping list, listen to the radio on the road, and other equally interesting tasks that modern gadgets can do.

In today's review, each of the applications deserves your attention, the functionality of almost each of the applications is unique and may be needed by different types of users. I made my choice in favor CoinKeeper, and which application is the best for you is up to you, of course.

To save yourself from big expenses and save up for a small house in a European province, you don't have to deny yourself everything and tightly sew your savings into socks. By installing EasyCost, you can achieve more: for example, save up for a one-room apartment. To do this, you just need to indicate the amount of your income and mark expenses every day. All costs can be divided into several cards: work, family, travel, and so on. This app is not without its drawbacks and has an extremely high barrier to entry for beginners, but if you can figure it out, you will get a handy financial planner.

Registration and Internet access are not required to use.

It is possible to select icons for manually created expense categories.

Overloaded, not friendly to beginners and completely non-obvious functionality with a bunch of incomprehensible buttons.

Acquaintance with new functions happens completely by accident, as a result of pixel-hunting across the screen. Most of the application options have remained a mystery to us.

Absolutely not obvious button with entering funds into the budget, hidden in the general list of expenses - look for a plastic card with the signature “Salary”.

m8 - my money. My way

The main feature of this application is the visualization of expenses in the form of two columns. After specifying your quarterly income and marking your expenses daily, you will observe the scale of expenses in the right column, and the remaining cash in the left column. The second feature of the application, which the developers are proud of: when a certain threshold of your cash reserves is reached, the smiley, serenely hovering above, will gradually begin to grow sad, until it finally frowns completely - this will be a signal that it is time to get off the couch and go to earn some more money.

A good visualization of expenses that clearly displays the state of affairs in your wallet.

By clicking on the smiley, you can see how your financial affairs are: very good, good, good or bad - the developers call this the current status.

If desired, you can change the emoji's emotions and stage names. For example, an emoticon will smile even though you are bankrupt.

Once you add a new expense line, it automatically joins the tag cloud that pops up with each typing. If desired, you can delete them in the settings.

Expenses can be hammered into the future and ex post.

The general diagram does not show the types of your income and expenses - you need to make one extra move to access them.

Money care

An application for meticulous bookkeepers and just big money lovers, ready, like Scrooge McDuck, to recalculate their income every free minute. If you are not afraid to sacrifice your time and convenience for the sake of accurate expense tracking, then this application will definitely take its rightful place on your phone. For all its unpretentiousness and external unfriendliness, Money Care has a rich functionality that allows you to take into account a bunch of different little things: watch your cost charts, divide costs among several people, and so on.

To prevent your notes from being lost, the application provides the ability to send a backup copy of the file to mail, Dropbox or Google Drive.

A hint system is provided for beginners. But even with it, it is not so easy to deal with it the first time.

All transactions can be divided into multiple accounts. This feature is especially useful for families with a shared budget.

You always have three indicators at your fingertips: income, costs and balance.

All information about your income and expenses can be exported to Excel and sent by mail.

For free, you will be allowed to make no more than 50 entries, and you will have to pay 99 rubles for the unlimited version.

Too complicated and lengthy process of adding income and expenses: type in the name of the transaction - confirm, add the amount - confirm, do not forget to assign a category - confirm, and then confirm the whole operation again.

Very small menu items - you need to have very thin fingers to get to the right buttons.

Daily budget

The perfect app for consumers with daily shopping syndrome, that is, for all of us. If you want to start saving money for something bigger than lunch in the cafeteria, this app will help you pull yourself together and calculate your daily expenses. To start a cost containment operation, you need to drive in your monthly income, indicate the amount of standard monthly expenses (for example, utility bills) and indicate the percentage of total income that you want to save in the piggy bank. With a little thought, the application will give you an amount that you can safely spend during the day.

To prevent you from getting fooled, the app provides reminders to enter expenses.

You can add a comment to each expense to justify your extravagance.

Moni

The most unpleasant feature of income is that it quickly turns into expenses, threatening to leave you without money at the most inopportune moment. To prevent this from happening so quickly, you can vow to only earn money without buying anything, or you can simply keep track of your costs. Thanks to Moni, your cash will always be in sight, all you need to do is to carefully mark each purchase.

If you live among thieves and hypocrites, then the application can be protected with a PIN code. Four identical digits are prudently not accepted.

There are tips for beginners.

There are no nice icons, colors or other visualizations for different types of expenses.