Family budget automation is a noble business and saves a lot of time. In the mind of the layman, a calculator is a way to quickly perform arithmetic operations. We will not deviate far from this concept.

1 Online home budget calculators

There are a huge number of different free services that are specifically designed to make it easier for the user to track expenses and income. The sites offer a meager list of mathematical software tools, which, nevertheless, do their job without any problems and complaints. For the family budget, data for the year ahead are important, this information allows you to imagine an overall picture of income and expenses over a long period of time.

The program automatically calculates annual values for all categories of expenses, calculates the balance for the current month and the average annual, provided that the picture of budget revenues and expenses does not change critically. A very convenient and incredibly simple program in order to quickly estimate the possibilities of your budget at your current salary.

Perhaps the Perm people are very concerned about their financial affairs. The official website of the Perm City Administration has published a very interesting calculator that will be useful primarily to local residents due to the possibility of calculating taxes online, but for residents of other regions of Russia, some of the functions that this simple family budget calculator offers will be useful.

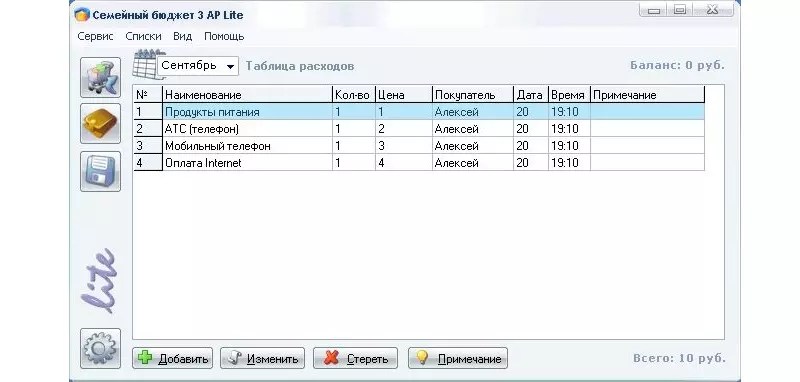

A simple program can be very convenient. Family budget for calculating expenses and income, which can be downloaded for free on the endless expanses of the Internet. There are many nice little features in the program that make it easier to summarize your monthly totals. A simple table of expenses and a clear interface is all that is needed for a household.

2 How to keep track of your home budget on a calculator?

A common calculator familiar to everyone from childhood is also a very useful tool in home budgeting. A small device is always at hand. It will be much easier for those who do not communicate with the computer "on you" it will be much easier to operate with a notebook, pen and calculator.

In this case, you need to adhere to certain rules for keeping records of expenses and income, and also do not forget about the need to take into account taxes and fees, which are also included in your expenses.

We propose to keep a very simple table in which you just need to write down all your expenses during the month. Unfortunately, categorizing spending in our case seems to be an almost impossible task, but for keeping track of household finances in real time, such a table is the best solution. It is very easy to draw it even in a notebook; nothing but a calculator is needed to keep records.

In general, the tasks of home accounting, even in its simplest form, will always be:

- Distribution of finances;

- Accounting and control over expenses;

- Income accounting;

- Summing up the results of the reporting period.

To do this, you can keep a dense ledger or just start a notebook in which you need to record all the successive financial transactions of the family during the day. The plate will look something like this:

As you can see, this is a simple way of keeping records of all income and expenses, which was used by our grandfathers. You can calculate interim and final monthly totals using a calculator or even the most common accounts... Ever wanted to feel like a real accountant of the times of Ilf and Petrov? Perhaps in our time it is archaic, but stylish and everything is also reliable!

3 Create a simple calculator on your computer

You can create a family budget calculator using MS Excel, which is available on almost all modern personal computers with Windows. Excel workbooks are easy to use. It will be quite difficult to automate the processes, but for a simple calculation of all income and expenses, we will not need to come up with millions of formulas. Simple addition and subtraction will suffice.

You can also use our tips from previous articles on Excel spreadsheets. Our calculator will also be a good tool for summing up investment activities, without which today you can’t go anywhere. Keeping track of all investments is a very important part of family bookkeeping and household finance in general. Even MS Excel templates have corresponding tools for calculating profits and dividends.

We always encourage our readers to pay attention to PAMM investing, considering that they are liquid and transparent enough for your investments to quickly earn and increase without your participation. On the other hand, if you pay attention to ours, you will notice that the diversification of deposits is very important for positive results. More bills - more numbers and values to take into account.

In our small table, we tried to take into account all sources of income and make automation simple and straightforward. Apart from the "SUM" and subtraction operations, no formulas were used. Everything is very simple! Nice and handy calculator for your personal budget!

Today we will look at useful programs for managing a family budget. Immediately after reading the review, you can download any application you like for free and use it for personal purposes.

Unfortunately, I could not find completely free programs for you. Each product has a trial period after which access is blocked. Therefore, I advise you to do the following:

- work with each of the listed applications in turn. If you use all the available time, it will take you several months;

- choose one product you like and buy its license. Since the cost of all the described programs does not exceed 1,300 rubles, every family can make such a purchase.

P.S. I recommend paying attention to the "". Financial literacy is taught here. How to properly manage personal finances in order to save up for a house, apartment, car. How to properly invest the accumulated money and increase income. Allow yourself to take annual vacations and travel around the world.

You can download the program here... The free version is designed for 2 weeks. If after this period you do not buy license for 400 rubles, temporary access will be closed.

Let's list the main features.

- You can add categories and edit existing variations.

- There are two calculators: one for ordinary calculations, and the second for working with loan amounts.

- A task scheduler is built in, where you can make upcoming payments. Helps not to forget anything and pay bills on time.

- There is a function responsible for the formation of a family budget plan. All data is structured and presented in Excel format.

- Each report can be displayed in the form of a chart or graph.

- The analyzed data can be combined into groups, intermediate values can be calculated and the result can be viewed in different currencies.

- A diary is connected, in which you can set reminders of the most important events of the day.

Home Finance is an inexpensive and very convenient program that will take a user some time to master. To make things easier for yourself, watch this video.

Home bookkeeping

To install the trial version, click here... To purchase a paid product for one PC, you will need 990 rubles. You can view all program options and make a purchase here.

Key features.

- In one program, you can calculate the budget of several family members.

- There are no unnecessary functions in the working panel, so it won't take much time to master all the functionality.

- In addition to the income and expenditure side, with this program you can control all loan payments.

- Electronic bank statements can be imported into the working window.

- The backup function reliably stores all the entered information.

Home Bookkeeping is one of the best programs to take control of your personal finances.

Home economics

Trial Profession Available here... To purchase the paid version, you will need 590 rubles. You can place an order on this site.

Key features.

- Distribution of income and expenses by category.

- Planning all financial activities.

- Availability of a savings calculator that is able to predict the inflation rate and choose the best investment deposit.

- Viewing exchange rates.

- Calculation and selection of the optimal loan offer.

In my subjective opinion, "Home Economy" is the best program that has everything you need to keep track of personal funds.

Moneytracker

Key features.

- An unlimited number of users can maintain records.

- The entrance to the program is performed through a personal password.

- An unlimited number of currencies are available for calculating and maintaining home accounting.

- With the help of a convenient search and color highlighting, the desired financial transaction can be quickly found and tracked.

- Making a list of necessary purchases and planned payments.

"MoneyTracker" is a good program that, after a short adaptation process, becomes an indispensable home assistant.

AceMoney

You will find a trial version in Russian here... You can buy the program for 1300 rubles at this site.

Key features.

- All accounts are divided by target criteria, can be supplemented and edited.

- Built-in 100 categories of expenses, through which you can track all outgoing financial flows.

- A section for working with savings and investments has been created.

- Every month, the user receives detailed reports, which indicate which part of the budget was spent on.

- A backup and password system will reliably protect all generated reports.

"AceMoney" is a simple, understandable and necessary program that will be especially useful for users who are just starting to get acquainted with the system of organizing the family budget.

Conclusion

Friends, we have completed a review of popular programs that will help you manage your personal finances. If you download them to your Android or PC today, I guarantee that next month it will be much easier to manage your home budget.

- "How to keep a family budget in a notebook - an example with tables of income and expenses."

- "How to properly manage, plan and save the family budget - 10 useful tips."

- "7 books on personal finance management whose authors have influenced millions of the lives of their readers."

In order to competently and simply keep the bookkeeping of the family, there is a program for the family budget, which is called "Home Bookkeeping". This software allows you to manage general and personal finances from various devices with data synchronization and exchange between a computer and mobile devices, since its versions work on Android, iPhone, and iPad. In a free test mode, you can use it for 30 days, after which you will be offered to buy the software. However, for those who do not want to spend money, there are other services freely available that structure household expenses and income. The best programs for accounting and maintaining a family budget, which can be downloaded for free, are presented in our review.

Home Bookkeeping Program

Since the offer from "Home Accounting" (http://www.keepsoft.ru/) can be used for a month for free, users who choose intuitive, simple and functional versions of the software can use this example to compare the capabilities of paid and free programs "in the field conditions ". Thanks to the function of uploading data to Excel in a month, you can return to the tables if you want without losing accounting.

The distinctive advantages of Home Bookkeeping include:

- The availability of using not just a list of incomes for each of the partners, but a link to the "common wallet" of the state of several accounts - cash, bank cards, electronic money.

- An interface in which you can see both the general picture in one table and each of the subsections in a separate window displayed on the screen (for example, the window for loans and debts).

- The ability to build visual diagrams that at a glance allow you to assess the current financial situation in the family.

- Additional features:

- planning income and expenses,

- import of data on bank statements,

- export to Excel, Word, Access, HTML

Unlike many free "blank templates", here the basic part is already spelled out. For example, items of possible expenses are entered in such detail that it is extremely rare that there is a need to add something (although there is such an opportunity, as well as the opposite - deleting an "extra" item). So the 16 main basic categories of expenses are subdivided into many subcategories. For comparison:

- in the category "Car" already entered 9 subcategories "by default": Car wash, Gasoline, Parts, Tax, Repair, Parking, Insurance, Inspection, Fine.

- in the category "Clothes" - 44 subcategories.

- in “Household goods” - 62 options from nails and hangers to light bulbs and filters.

Thanks to such detail and even the "meticulousness" of the authors, it is much easier to plan, since the menu itself seems to suggest something that is usually forgotten in everyday chores.

Separately, it should be noted the search function with detailing by name, category-subcategory, repaid and outstanding debts, notes, etc. That is, by entering a marker word into a note, you can use the search to immediately see all movements that relate to the "encrypted" topic ...

The mobile version of the service differs from the offers of most competitors in its functional variety, which becomes noticeable already when looking at the start menu.

The mobile version of the service differs from the offers of most competitors in its functional variety, which becomes noticeable already when looking at the start menu.

Home Bookkeeping has a lot of good reviews from users with many years of experience, noting its advantages, and one "drawback" - it is paid. The software allows you to log in by changing usernames and conduct independent budgeting. However, in a paid offering, this advantage is leveled, because for free use by several family members, most likely, you will need to buy a more expensive license.

In total, there are 3 main options and a monthly subscription with renewal:

- Private license for installation on one computer - 800 rubles. during the discount period and 990 rubles on an ongoing basis.

- Family license for two computers 1200 rubles. at a discount and 1490 rubles. - without.

- The same is the price of a portable (recommended by the manufacturer) option for free movement of the program on a USB flash drive.

"Family budget": program, reviews, opportunities

"Family Budget" is a program for Android, the free version of which can be considered as a good example of bringing a useful product to the market for nothing. Of the minuses of use, only they are called:

- the presence of ads that can be turned off for money,

- the ability to back up only to a memory card of a mobile device in version 2.1.11, while you can download the family budget program for free and without registration in version 2.2.5–2.2.7 (for example, here http://top-android.org/programs / 1379-semeynyiy-budjet /) - general requirement: Android 2.1 and higher.

Family Budget is an official mobile application for Android that duplicates the functionality of a web service for accounting.

The advantage over desktop competitors is that in a mobile application all expenses can be entered without leaving the checkout and without forgetting about them.

And there are a lot of such everyday petty waste and it is they that require special accounting, since, according to statistics, the general treasury is imperceptibly melting not when buying TVs and refrigerators, but because of snacks, coffee breaks and unaccounted beer on Fridays.

To create a new record in the accounting history, you need to:

- select a menu item,

- enter the amount of expenses and a note,

- mark a category (either create it yourself, or choose from a ready-made list).

The functionality added in later releases allows you to specify the means of payment, recording the state of funds on a bank card and cash in a wallet. Synchronization with the Mobile Bank is available. A separate section is devoted to planning potential costs.

- At the beginning of the month, the total amount of upcoming expenses is calculated and indicated.

- The amount is signed by category, indicating the part planned for food, utilities, repayment of loans, etc.

- The end of the month shows savings or negative balance.

As in the previous software, this application provides a search, the ability to leave notes, and also generate a report on movements in the family wallet in the form of diagrams.

AndroMoney, CoinKeeper, Expense Manager AndroMoney

Similar to the previous and yet another multifunctional AndroMoney application, which is also used to keep track of housekeeping on Android devices. The goal of the developers was to make an interface for housewives - an intuitive menu without sacrificing functionality.

There is a free version and a Pro version (about $ 5). The advantages include: the choice of "step" (day, month or year), narrow budgeting for certain categories and the ability to create copies both in the device memory and in cloud storage services (Google Drive, Dropbox). The data can be password-protected and, if necessary, converted to CVS-format for work on a PC.

CoinKeeper

The difference between the shareware (the test version is used for the first half of the month) of the CoinKeeper platform from others is that both "manual management" of your finances and automatic mode are allowed, for which you must first specify the monthly income. The work will be facilitated by the fact that each menu item is explained, thanks to which the platform has one of the most understandable interfaces among similar products.

Allowed: synchronization with other devices, storage in cloud services, setting a password. But, in comparison with others, this application has few reports, there is no "desktop" version, slow animation.

Expense Manager (from Bishinews)

In Expense Manager (from Bishinews), in addition to the limited functionality of the free version (the full version also costs about $ 5), the lack of the Russian language is considered a relative disadvantage. In the English-speaking environment, the multi-million dollar download demonstrates the popularity of this software. Here you can plan the ratio of income and expenses, change the settings for yourself, display a detailed schedule of expenses, store information in the "cloud" or on a memory card. The interface looks minimalistic, but this only simplifies the work of both the user and the gadget.

Resolved! We begin to keep track of expenses and income. How? Someone writes them down in a notebook, someone keeps a table in Excel, and we advise you to download a convenient free program to your mobile phone. Earlier we already talked about them, now we decided to open this topic.

The team of Platiza, an online service for instant financial assistance, has tested several of the very best personal finance management programs and prepared a fresh review especially for you, dear readers.

UPD This overview presents applications in which you need to enter data yourself. However, quite recently there was a mobile application for Android - Balance, which automatically calculates your total balance, expenses for the current month and forecast for the balance. To do this, you just need to load the data of your bank cards into it with the SMS-informing service connected to them. Modern technologies based on artificial intelligence will make accounting for personal finances easier and more convenient.

1) The simplest is the Wallet

A very simple application, made in a minimalist style. It is convenient and easy to use. There is money - we press "plus" and enter the required amount, spent - select "minus". The amount in the middle is the total for the current account. You can create any number of such accounts. The program is perfect for beginners.

Pros:

Password protection

Fast tracking of expenses and income

Ability to add photo, audio and location

Clear summary balance

Minuses:

No distribution of funds by day

No detailed statistics and graphs

Available on iOS only, no Android version

Supports: iOS

The application is used by several people from our team at once: analyst, PR manager and technical director. Rated 5 out of 5.

2) The most caring thing is Zen-Mani

The application will help you plan payments, draw up a budget and set financial goals. The main difference from others is that it recognizes sms from banks.

Pros:

Recognizes sms messages from banks, while you can enter transactions manually

Integrates with electronic money systems like Webmoney and Yandex.Money

Can work offline, and download changes when connected to the network

Minuses:

Does not show total costs for the current day on the "statistics" tab

Supports: Android, iOS and PC.

Our programmer Zhenya has been using this application for several months and is very satisfied, the score is 4.5 out of 5.

3) Most advanced - EasyFinance

The service makes it possible to create several accounts, link them to bank cards. Category lists and currency are customizable. It allows you to set financial goals ("apartment", "car", "rest") and control their implementation: the service makes recommendations if you too rarely save money for one of the planned large purchases.

Pros:

Automatic synchronization of transactions via SMS

Convenient budget and goal planning

You can enter the operation offline

There is a tab "loans"

Minuses:

Most useful services are paid

No multiplayer mode

Supports: iOS, Android

Our marketer likes the app, 4.8 out of 5.

4) The most intuitive - Where is the Money

A beautiful animated application, before using it, it offers to familiarize yourself with a demo version of the wallet, which is very convenient for beginners. There are popular categories, but you can create your own.

Pros:

Unlimited number of accounts

A quick overview of the current period on the summary screen

Password protection of data access (support for touch ID)

Minuses:

Full control over the creation of categories and subcategories

Supports: iOS only

Web designer and sysadmin give "Like". Rated 4.7 out of 5.

5) Most playful - CoinKeeper

Personal finance application with large colorful icons, user-friendly statistics graphs and an intuitive interface. Costs are set up in this way: you need to move a coin on the screen from one field to another. The "automatic budget" function allows the program to calculate the main categories of expenses for the month.

Pros:

You can set reminders for recurring expenses

Family Sharing from Multiple Devices

Sends reminder notifications

Beautiful statistics, bright and clear charts

Financial goals help you save up for what you dream of

Minuses:

The interface seems complicated at first glance

Supports: iOS, Android

Olya, an overdue debt collector, recommends this particular application. Rated 4.5 out of 5.

6) Funniest - Toshl

Spending can be tracked by category, which is self-configuring using a tagging system. There is an assistant in the application, a three-eyed alien, he gives rather amusing hints, warning of a possible budget exceeding: “There may not be enough money! Pull yourself together. "

Pros:

Daily reminds that you need to keep a budget at a certain time, which you can set yourself

Beautiful graphics, funny characters

Supports data export

Minuses:

Registration is required, but it is simple and fast

Tags are entered manually

Many additional features are paid

Supports: iOS, Android, Windows Phone

The application is used by our tester. Rated 5 out of 5.

7) The most convenient - Budget (Budget)

The application differs from all others in that it allows you to specify the monthly income and displays the remaining amount for the day, taking into account constant and planned payments. If the amount per day is exceeded, the remaining money is recalculated, respectively, the amount per day is reduced. Very clear. Disciplines to stay within the daily budget.

Pros:

Nothing superfluous, the application is not overloaded

It is clear exactly how much is left for the day

You can enter all your monthly expenses, the application will calculate everything automatically

Sends reminders

Minuses:

Does not allow you to set the dates of receipt of salaries

Supports: iOS

The project manager has been using this application for six months. Everything suits me. Rated 4.5 out of 5.

8) The most visual - M8 - my money

Are you used to spending several hundred rubles a day on various nonsense? Using this application, you will understand that by saving on chocolates, you could buy yourself something more or less worthwhile. Minor expenses add up to a large figure. The pie chart clearly shows what you spend most of your income on: transportation or, for example, food.

Pros:

Clear and simple interface

Minuses:

- there is no option to indicate expenses for the last month

- no income accounting, only expenses

Supports: iOS, Android

The application is used by our manager of the quality control department. Rated 3 out of 5.

Do you keep track of finances? If so, how? Share your experience in the comments with us and other readers.

Looking for free home accounting software? Then you've come to the right place.

Household bookkeeping is the success of maintaining wealth in the family.

You can control income and expenses as in the old fashioned way, i.e. in a notebook, and by modern methods, by installing the appropriate software on a PC.

In particular, we will consider 5 of the most convenient and common programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Bookkeeping Lite.

HomeBank

Free application that allows you to keep track of your finances.

With the help of the software, you can fully control your income and expenses, plan your family budget, analyze your expenses and more. Take full control of your spending.

The program supports tight integration and data import from Microsoft Money and Quicken services, as well as other applications for managing your own funds.

Supports QIF, QFX, CSV and OFX formats.

The functions provide for the detection of duplicate transactions. This avoids confusion in calculations and clutter in the database.

Note! You can organize transactions by categorizing them. You can also schedule the automatic addition of receipts to the created database by adding various tags and more. There is also a function that allows you to edit several fields at the same time, which greatly speeds up and simplifies the accounting process.

Set an annual or monthly budget level for each category as needed.

Generate dynamic reporting that reflects the current state of your financial position. If necessary, they can be provided with diagrams for clarity.

Family Budget Lite

This program is designed to relieve your agony in relation to the calculation of personal spending. All you need to do is enter your own income and expenses in the appropriate columns.

The program will do all other operations on its own.

The customer benefits are as follows:

- the profitability is taken into account for several main categories and accounts;

- you can deal with accounting for your own debts, loans, investments, deposits and other settlements;

- you can use the auto-categories function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report from 8 parts with one click;

- export to HTML, BMP, TXT, Word, etc. It is also possible to print and save the document.

The client can be used by several people at the same time. Moreover, everyone will have their own account and password.

The latter can be installed when starting the application.

Searching for income and expenses is very convenient, since it is possible to set up the search results by several filters at once: product, date, category, etc.

Family Accounting

If you do not want to systematically wonder where money is constantly going, use this program.

You do not have to speculate and remember where the money went, which was put off for so long for an important purchase, but at a critical moment took and evaporated in the literal sense of the word.

The program will allow not only to analyze, but also to control the proceeds. You can also plan your own expenses by thinking over the budget more carefully.

The client has enough opportunities:

- accounting of income and expenses;

- accounting for debts (both borrowed and borrowed);

- analysis of financial transactions;

- possibility of accounting in different currencies.

CashFly is a simple and very user-friendly program for accounting personal financial transactions.

You can create tiered structures that display items of income and expense.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other important financial information for you.

It includes an address book, a list of organizations, and a personal diary that allows you to record reminders of important events for you.

The application is capable of keeping records in almost any given currency, performing scheduled calculations and printing data.

Databases are password protected for greater security and safety of content.